Optimizing LendingClub’s online banking with AI Assistant

Timeline

August- December 2024

Team

Bon Bhakdibhoomi William Downs and Theresa Antony

Overview

Role

Lead UX Designer Lead UX Researcher

Industry Sponsers

Sally Xia Eilish McVey Carrie Bruce

As larger institutional banks rapidly integrate AI driven chabots and virtual intelligence into thier mobile banking experience, LendingClub must adapt to stay competitive and better support its target audience, many of whom lack access to clear, actionable financial insights to make informed online banking decisions.

PROBLEM OVERVIEW

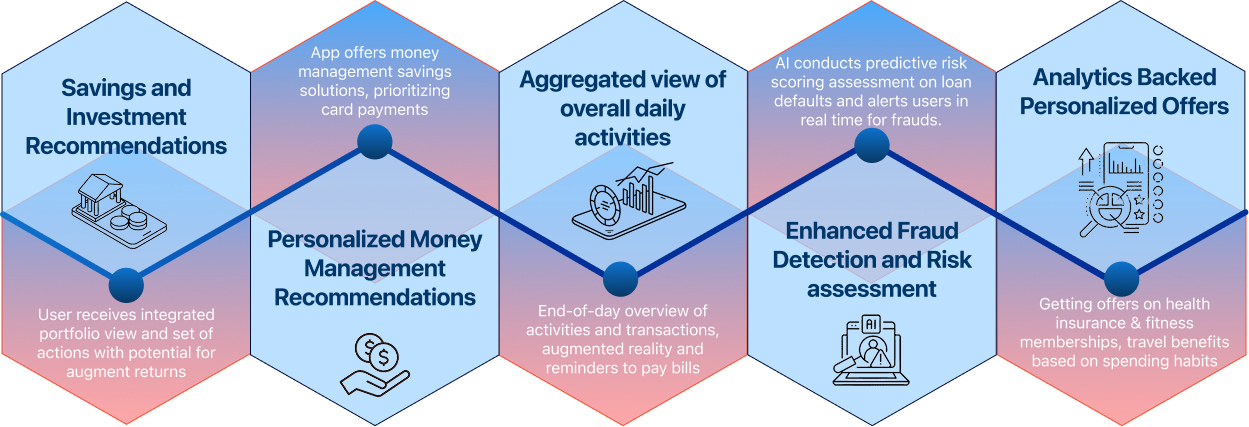

As banks increasingly adopt AI to optimize digital banking, LendingClub faces the challenge of integrating AI across its lending, banking, and investing services without increasing cognitive load. And while AI can enable capabilities such as fraud detection, risk monitoring, and personalized insights, its value addition depends on a focused, transparent application within a unified platform.

Applications of Artificial Intelligence in Online Banking Platforms and Example Use Cases

DESIGN CHALLENGE

How might LendingClub strategically integrate AI into its digital banking experience to improve efficiency and decision-making while preserving clarity, user trust, and control?

CURRENT SOLUTION

While LendingClub provides a unified platform for banking, lending, and credit products within one interface- it lacks personalized, AI-driven features within the app’s core experience.

TARGET AUDIENCE

LendingClub aims to expand its appeal to younger, digitally native users by incorporating AI-driven features that make banking more efficient and responsive to real-time financial needs.

Thus, we asked ourselves the question,

OUR SOLUTION

ClubAI Onboarding Experience

Design Rationale: Data Transparency & Trust

In the onboarding experience, the user is prompted about where their data is stored and lets them choose what data to share with the AI chatbot.

The biggest insights we got from our users was that they wanted transparency for where their data is going when using AI products. Some examples of data you can give are your bank account information, frequent expenses like rent, utilities or other bills, and also credit card information.

Debt IQ Financial Insights & Goals

Design Rationale: Growth & Personalization

AI Chatbot: Financial Advice & Personalization

Design Rationale: Financial Control & Limits

The ClubAI chatbot interface helps users get financial advice, analyze their financial data, and also get their banking information, like their monthly transaction history.

The chatbot generates answers that are relevant to users' needs based on the information it has access to. Every time it gives an answer, it also gives the source that it’s referring to, for proof of all the resources used to advise.

The last feature is financial visualization and analysis. With this tool, you can set budgeting goals, review your financial progression, and see insights about your credit score. This feature would be a part of Debt IQ, which is a smart assistance tool LendingClub already uses.

The visualization shown is directly linked to the user’s account and is clearly stated so. The auto-generated categories and saving goals are based on the user's spending habits.